who pays transfer tax in philadelphia

Effective October 1 2018 the transfer tax for the city of Philadelphia is 3278 with an additional state of Pennsylvania tax of 1. How is Philadelphia transfer tax calculated.

1845 S Conestoga St Philadelphia Pa 19143 Mls Paph2156240 Trulia

The locality charges a second fee usually totaling about.

. Transfer tax is usually paid by the seller when the property ownership is transferred to the buyer although there are cases where a buyer may take on the expense. It is important to know when you may be eligible for one of the many transfer tax exemptions. Current participants of our ACH Debit payment program can continue to use ACH Debit to pay all other City taxes until September 20 2022.

Our offices can work with you to determine if your real estate transaction may qualify and can help. Luckily it is customary but not legally. Transfer Tax on Real Estate One percent is collected by the Commonwealth of Pennsylvania while 3278 percent is collected by the City of Philadelphia for a combined total.

Philadelphia Realty Transfer Tax. It is important to know when you may be eligible for one of the many transfer tax exemptions. Our offices can work with you to determine if your real estate transaction may qualify and can help.

Pennsylvania realty transfer tax is imposed at a rate of 1 percent on the value of real estate including contracted-for improvements to property transferred by deed. Realty Transfer Tax The Commonwealth of Pennsylvania collects 1 while the City of Philadelphia collects 3278 for a total of 4278. How Do I Calculate Transfer Taxes In Philadelphia.

The PA deed transfer tax is generally about 2 of the final sales price which consists of two different sets of fees. Realty Transfer Tax The Commonwealth of Pennsylvania collects 1 while the City of Philadelphia collects 3278 for a total of 4278. Luckily it is customary but not legally.

3278 City 1 Commonwealth 4278 Total The tax rate is based on the sale price or assessed value of the property plus any. The current rates for the Realty Transfer Tax are. Buyer Closing Costs Philadelphia Home 750000 purchase price 20 down payment Pennsylvania Realty Transfer Tax 3750.

Pennsylvania realty transfer tax is imposed at a rate of 1 percent on the value of real estate including contracted-for improvements to property transferred by deed instrument long-term. Pennsylvania imposes a 1 transfer tax on the value of the real estate being transferred while Philadelphia imposes a 3278 tax on the value of the real estate being. You would be required to pay transfer taxes in that scenario.

The city of Philadelphia has an 800 percent sales tax rate which is made up of 600 percent Pennsylvania state sales tax and 200. Solution When you submit the sale document for recording you will be required to pay the Real Estate Transfer Tax. Theres also a 327 Philadelphia Realty Transfer Tax to take care of in addition to a 1 tax from the Commonwealth.

Most tax payments can be made. Pennsylvania realty transfer tax is imposed at a rate of 1 percent on the value of real estate including contracted-for improvements to property transferred by deed. The Transfer Tax is imposed on the propertys sale price or.

Department Of Revenue Homepage City Of Philadelphia

Philadelphia Property Tax Reform A Progressive Alternative Campus Activism The Blog

City Releases Property Tax Calculator To Assist Homeowners Department Of Revenue City Of Philadelphia

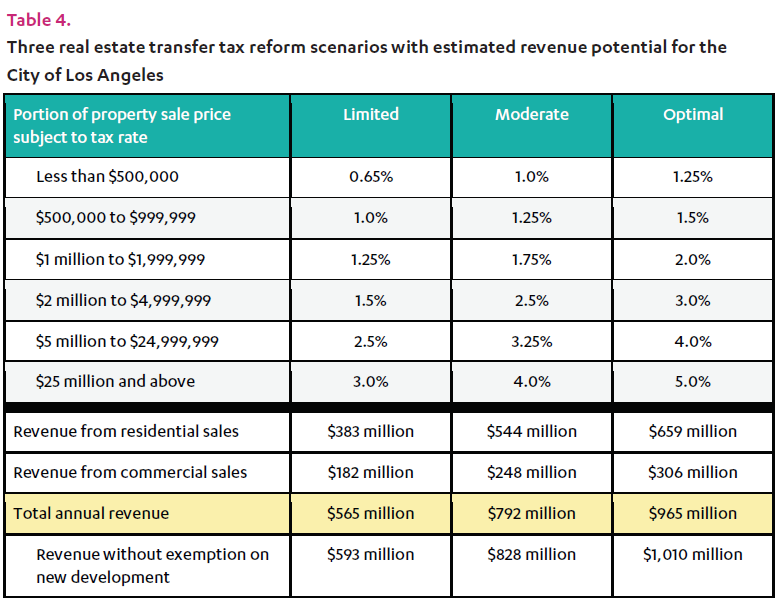

Building A More Equitable California With Transfer Tax Reform Better Institutions

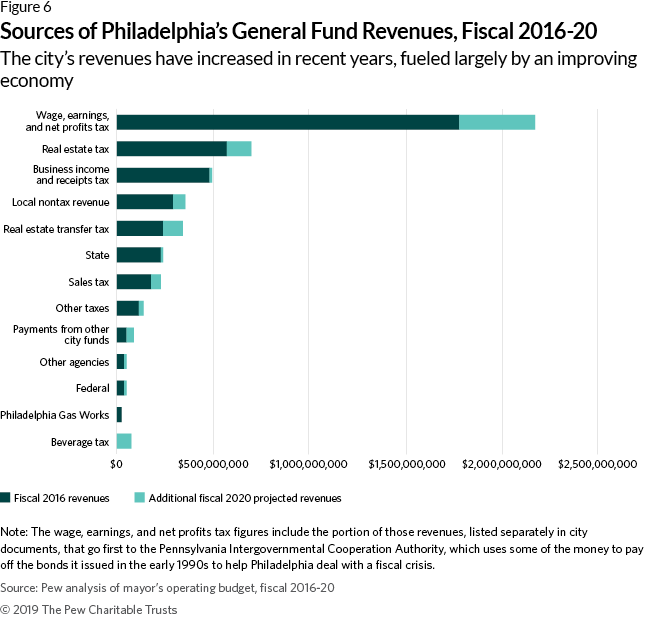

Philadelphia Is Richer Than It Was In 2016 So Where S All That Money Going

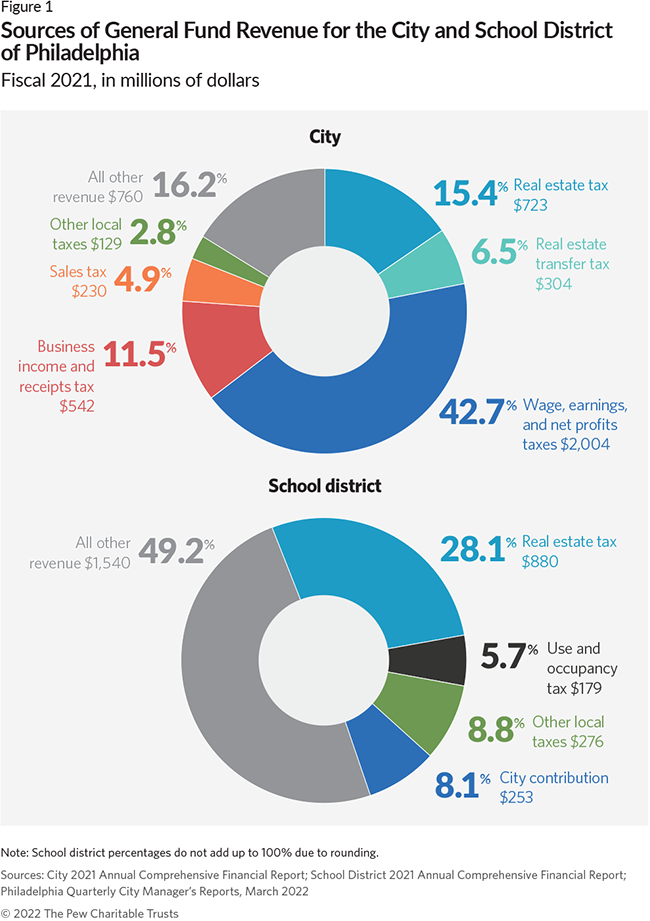

How Property Is Taxed In Philadelphia The Pew Charitable Trusts

Transfer Tax Definition Examples Calculate Transfer Tax

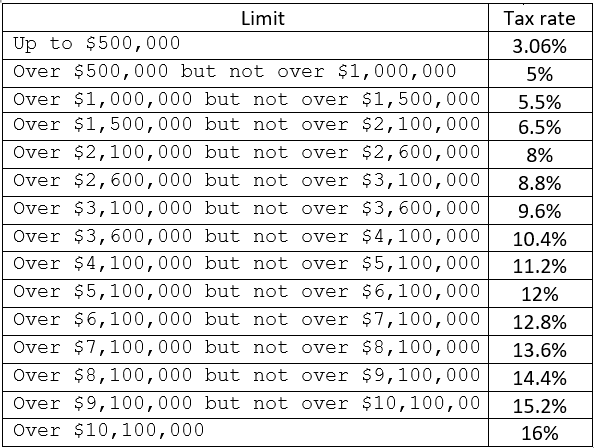

Nyc Nys Seller Transfer Tax Of 1 4 To 2 075 Hauseit

Economy League Philadelphia Budget Analysis

Philly Realty Transfer Tax What Is It And How Does It Work Department Of Revenue City Of Philadelphia

Property Tax Bill Gone Missing Here S How To Get A New One Department Of Revenue City Of Philadelphia

Bipartisan Support To Roll Back Delaware S Realty Transfer Tax Whyy

/cdn.vox-cdn.com/uploads/chorus_asset/file/9432777/shutterstock_724770679.jpg)

A First Timer S Guide To Buying A Home In Philly Curbed Philly

Chicago Referendum Campaign Launched To Increase Real Estate Transfer Tax On Multimillion Dollar Properties The Civic Federation

Pennsylvania Real Estate Transfer Taxes An In Depth Guide

How Property Is Taxed In Philadelphia The Pew Charitable Trusts

The German Real Estate Transfer Tax Evidence For Single Family Home Transactions Sciencedirect

Grk Multi Services Tax Preparation And More Philadelphia Pa We Also Speak French And Haitian Creole